Bitcoin’s Game-Changing Features You Need to Know

In October 2008, a white paper was released of a new form of global currency by an author who would become a mystery to many for over a decade – Satoshi Nakamoto. The white paper vehemently broke the internet, but the major seismic quake has over time been felt in the financial world.

Satoshi’s Bitcoin was not the first attempt on digital currency. Several notable attempts were made at the close of the 20th century, including one by American Nick Szabo who created a similar currency known as Bit Gold in 1990. However, Bit Gold never came into public implementation.

Get Your Custom Essay Written From Scratch

We have worked on a similar problem. If you need help click order now button and submit your assignment instructions.

Just from $13/Page

Bitcoin’s introduction to the public in February 2009 as a form of digital peer to peer currency spurred a debate as to whether the world will finally have a digital currency that has the benefit of convenience like fiat currencies, and is decentralized and trustworthy to enable satisfactory transactions between two people.

Qualities of Bitcoin as a Currency

- A decentralized currency

Bitcoin’s creator built a system and released the software publicly on internet platforms. Satoshi made the first transaction and went on to gather about 1 million bitcoins from conventional means including 50 BTC as a peer node for verifying transactions and other means as well such as transactions. However, Satoshi wrote his last email in 2013 and has disappeared from the public ever since.

First, Bitcoin software is an open source project, meaning anyone can contribute to it by posting review suggestions. A group of developers funded on donations controls Bitcoin Core – an affiliate organization that is entrusted and selected by the global community to review suggestions on the Bitcoin Software and maintain it. Otherwise Bitcoin has no central overseeing authority, and is controlled by peers such as you and me.

Secondly, the financial network runs on its own, and is expected to remain so in eternity. In fiat currency, the government has control over the introduction of new currency through central bank mints. Conversely, Bitcoins are introduced into the network through peer nodes that are incentivized for verifying transactions and registering timestamps (proofs of work) as a block appended to the blockchain.

2. Electronic, autonomous cash

By the virtue of bitcoin remaining decentralized and without any central power controlling the circulation of the currency, the electronic form of value ownership is self-limiting and devoid of any monetary crises categorized as human made.

Bitcoin’s parent algorithm defined the distribution of coins over time to maintain a stable circulation. As mentioned earlier, coins are introduced into the economy by peer nodes, who are basically owners of computers that compete to verify sets of bitcoin transactions and in return the node owners are awarded a bitcoin incentive. Bitcoin circulation was capped at 21 million, and what would change is only the value of a single coin which has evidently gained value over time. This way, the economy will remain in control of itself with the value of the currency only controlled by market demand and supply dynamics.

Again Bitcoin is not eternal. At some point the coins will cease from production and the 21 million coins will remain as the only coins in circulation, decimated into smaller fragments called Satoshis. This (capping) is possible through an algorithm known as halving. Nodes (Bitcoin miners) who verify transactions were first awarded 50 BTCs in the first 210,000 bitcoins mined. After every 210,000 coins mined, which has been approximately set at 4 years, the incentive to miners is reduced by 50%.

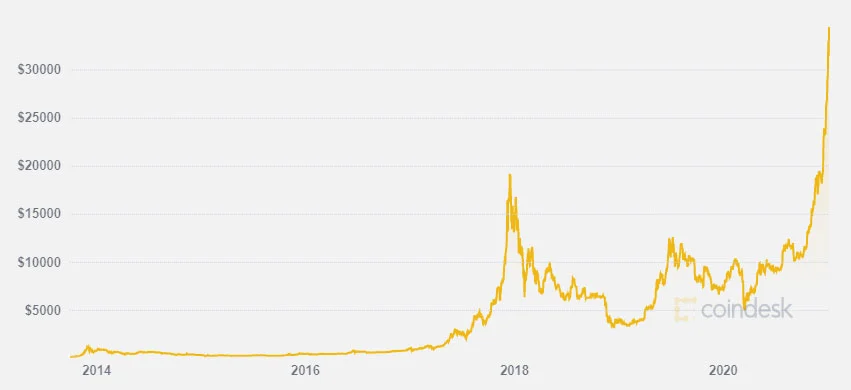

It has been about 12 years since mining started, and the incentive has since decimated to 6.25, and the incentive is set to go down further to 3.125 in 2024. While only after 15 years the BTC circulation has reached 19 million, 21 million might seem so close. However, due to the halving effect, the cap can only be arrived at at 2140 latest. Till then, miners will still be validating and getting awarded bitcoins, but their value will be prominent given demand keeps growing in the upward trajectory.

Check out our article on the profitability of bitcoin mining:

3. Irreversible transactions, impossible for double spending

One initial concern with digital/electronic cash was its susceptibility to double payment. This happens when a previous owner of electronic cash, through their own means, retains the original cash or fraudulently reproduces the original money after making a transaction. In Bitcoin, this can only happen when an attacker alters with the information to be appended at the blockchain. After every transaction, miners are required to create a specific hash attributed to specific transactions.

The first hash to be produced is appended to the blockchain. If the attacker creates a modified hash and interferes with the blockchain information, double spending will ultimately be possible.

However, Bitcoin’s algorithm was created such that hashes are created in a short time – one block after every 10 minutes. The attacker must manage to create the modified block within this short period, which is practically impossible considering a billion combinations are possible and one has to be found within that time.

4. Highly Unstable

Bitcoin, unlike fiat currency, cannot be stabilized by any means possible. In fiat currency, the government through the central bank can increase interest rates to control inflation and monetary circulation, thus restructuring the economy. Bitcoin currency is, however, controlled by demand and supply dynamics. Bitcoin is often quoted as a remedy for the events around the Financial Crisis of 2008.

Cryptocurrencies may, however, surprisingly become more volatile than cash, and are more prone to a financial crisis than cash. Many have termed Bitcoin as a bubble that can not be entrusted with the global economy, an insinuation that has attracted severe regulations, with countries like China absolutely banning the mining of Bitcoin in the country.

Although it is impossible to permanently erase Bitcoin from the digital world, the government can put in place very strict regulations in the production and use of bitcoin as an exchange/transactional currency.

Most governments that have deliberated on the use and circulation of cryptocurrency have categorized it as a form of taxable security, and even if it is legalized in most developed countries like the USA and Europe, it still has no foothold as a legal tender.

Needs help with similar assignment?

We are available 24x7 to deliver the best services and assignment ready within 3-4 hours? Order a custom-written, plagiarism-free paper